carried interest tax reform

Unfortunately the legislation was drafted hastily and there are many questions which will need to be addressed either by further legislation or by regulation. The Outline of the 2021 Tax Reform Proposals Proposal which was agreed by the ruling coalition in December 2020 described that where the distribution ratio has economic rationality etc.

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

He notes among his findings that as a matter of both efficiency and equity capital gains relief is best targeted where tax rates are high as in the case of the double taxation of corporate income.

. The proposal approved by the House Ways and Means Committee in September which is part of a large tax and spending package currently being debated in Congress aims to change the law to significantly modify the so-called carried interest loophole by limiting situations that are eligible for the more tax favored long term capital gain LTCG treatment. Currently the managers of private investment partnerships are able to receive compensation for these services at the much lower capital gains tax rate rather that the ordinary income tax rate by. Sander Levin today reintroduced legislation to tax carried interest compensation at the same ordinary income tax rates paid by other Americans.

Thats the opinion of two of Washingtons most prominent taxpayer. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. Among many other changes the TCJA added new IRC section 1061.

Which isa capital gain - NOT income in the traditional lets-tax-it-at-the-higher-rate sense. In which the fund managers have an equity interest. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. Eugene Steuerle gave testimony on the taxation of carried interest before the US. Hedge funds for example typically trade stocks bonds currencies and.

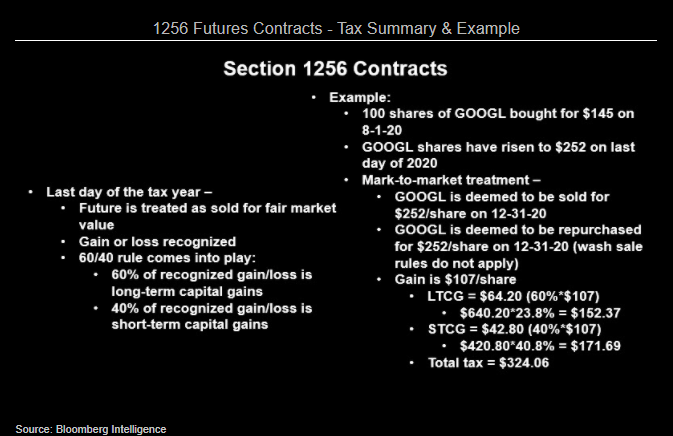

This new section extends the holding period for long-term capital gain or loss treatment as it relates to carried interest. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains. House Committee on Ways and Means.

Under the Discussion Draft the current tax brackets for individuals would be consolidated into three brackets. The graph above puts the treatment of carried interest in the context of other well-known provisions of the tax code. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital.

These funds invest in a wide range of assets including real estate natural resources publicly traded stocks and bonds and private businesses. Carried interest is taxed2 The most recent effort to address the tax treatment of carried interest was in the federal Tax Cuts and Jobs Act PL. Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits.

Senators Sherrod Brown D-OH Tammy Baldwin D-WI and Joe Manchin D-WV introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. As President Trump and Congress ramp up discussions on what comprehensive tax reform should look like they ought to be able to agree that reducing not raising the tax burden on badly-needed investment is a top priority. But its also possible that even if tax reform efforts fail or stall carried interest legislation could find its way into an extenders package or as a pay-for for deficit reduction or an extension of the debt limit.

Carried interest reform will almost certainly be part of any major tax reform bill offered by Camp or Baucus. In fact they desire to do that with all capital. Get all that.

Tax Reform Must Retain Carried Interest As A Capital Gain. Like saywe 99-ers saving for our retirement. For the Carried Interest that the fund managers receive from the partnership whose business is transfer of shares etc.

In fact President Joe Biden has vowed to raise taxes on all capital gains to 434 percent a tax hike that would harm the 53 percent of American households that own stocks. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. Enacted as part of the 2017 Tax Cuts and Jobs Act Section 1061 was the first step taken to curtail the preferential treatment of carried interests.

Tax reform introduced new rules seeking to increase the likelihood that fund managers carried interest would be taxable as ordinary income rather than long-term capital gain. Raising taxes on carried interest is just one part of the lefts goal to raise taxes on all investment. The key change established in Section 1061 is that carried interests must be held for three years rather than the normal one-year period to qualify for long-term capital gains treatment.

According to the most recent figures from the Joint Committee on Taxation treating carried interest as ordinary income would raise only 132 billion in 2016 and 1564 billion over ten years. 10 25 and 35. Carried interestis individuals investing in the marketplace - for future use when they cash out.

Carried interest - is a tax on long-term investment income. The 35 bracket would begin at 400000 for single filers and. Democrats have long sought to tax carried interest not as a capital gain despite the fact that it clearly is such but as ordinary income.

Carried interest allows hedge funds to evade their tax obligations. Washington DC Rep.

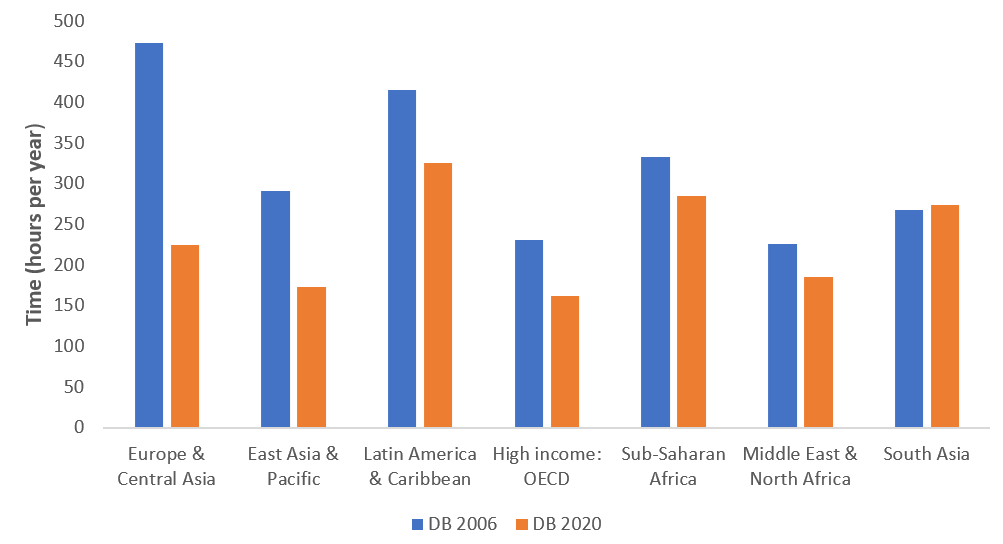

Paying Taxes Reforms Doing Business World Bank Group

Get Your Business Gst Ready With Easy Accounting Business Accounting Software Accounting Services

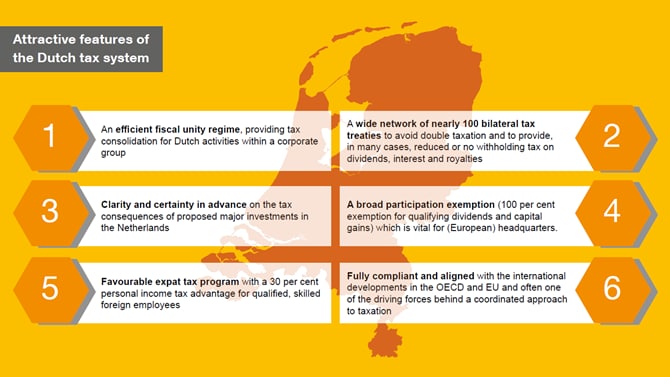

Dentons The Netherlands Tax Plan 2022

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

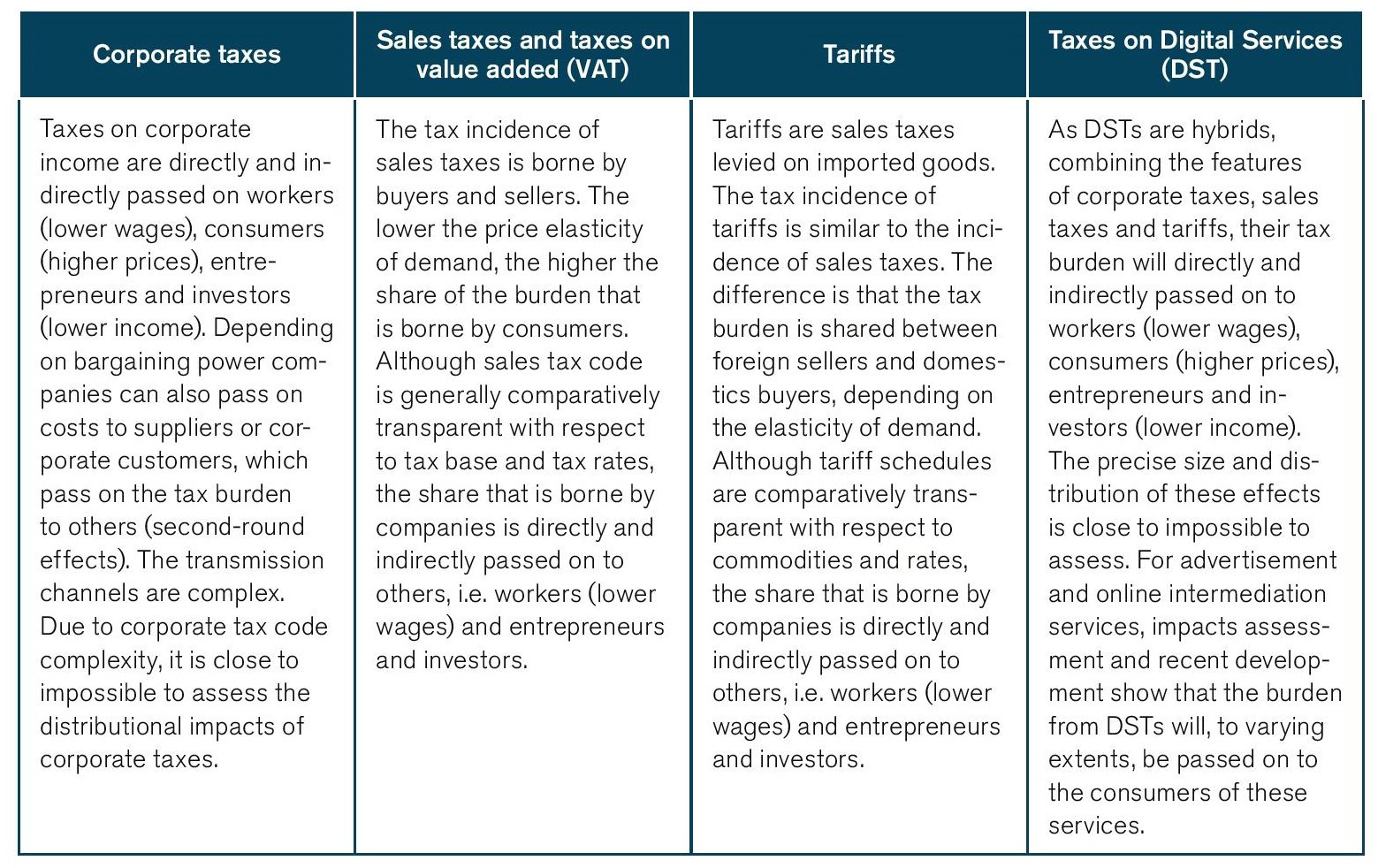

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

How To Tax Capital Without Hurting Investment The Economist

Holidays List Banks To Remain Closed For Up To 9 Days In April In 2022 Instant Loans Bank Of India Personal Loans

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure Goulston Storrs Pc Jdsupra

Treasury Proposes Carried Interest Regulations Jones Day

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Gst Returns Due Dates Accounting Taxation Due Date Dating Goods And Service Tax

His Word Means Nothing Words Mean Nothing Truth True Words

Dentons The Netherlands Tax Plan 2022

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform